Not sure if this is a Father Knows Best post, or if it belongs under whatever we called the Nation's recommendations (like what kind of refrigerator, cell phone, pocket knife, stereo system, etc. we use or recommend... we had that, didn't we? [updated! thanks sean]), whatever, I digress. I owed the basement a FKB post in July and didn't make time to do it. This is about midway between Philo's Oct. posting and Nibbs' November posting timeframe, so I'm dropping it here.

My wife and I have been working through some of the adulting items recently highlighted by hj and others. Over the past 2-3 years, we've managed to knock out quite a few major items (started 529's, got the life insurance and retirement accounts up and running and last week we finalized our estate planning (will and health care directives). I've found the citizenry's conversations about kids & college, aging parents, home purchasing and personal finances in general here to be very useful. The conversations, coupled with the encouragement to tackle these now rather than later (by those further along in the process of growing up) has been a catalyst to my willingness to actually get started (so thank you).

I consolidated and shared that most recent discussion with my wife. For clarity, I eliminated attributions, unrelated/side-bar lte's, and the spoilered FZ stuff and made some minor edits and deletions. (Any mistakes/errors or misrepresentations are mine.) She had trouble following the conversation (doesn't know how conversations work in the basement) so I set it so that each new indent represents a response to the previous comment, and those aligned left represent a "new" piece of input.

She responded with her notes from a financial planner presentation her employer brought in. I'm sharing both here for posterity.

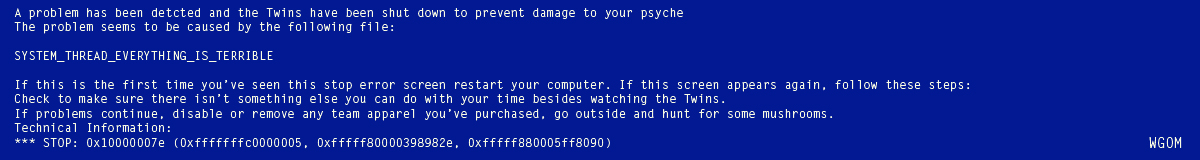

WGOM DISCUSSION THREAD

Important #1: if your company has a 401(k), start putting money into it now, especially if there is matching. Every time you get a raise, kick it up another 1%

Important #2: pay off your credit cards and don't use more than you can pay off each month

RE: #1. The only thing I'd caution is that, if there isn't matching, sometimes it can be more valuable to pay down debt now first. If you can afford to do both, do. But if interest on debt > rate of return on 401(k) (or even less, depending on credit score effects and desire for future borrowing, i.e. mortgage), then it makes sense to pay down debt first.

Agreed. but don't put off 401(k) long -- the earlier you start, the better.

That's one thing I did do, though I only contribute the minimum to get the maximum match from my employer.

Right, and if there's an employer match, that's always the better way to go.

Index funds are your friend. They are the closest thing to following "the market" there is and have incredibly low fees. I can't comment on which one to pick as my expertise is very limited.

401(k)s are generally your friend, at least to the point that ostensibly your company is helping you. Or maybe it sucks and you're screwed. John Oliver featured them a few months ago on his show. You can skip to the end for his (swearing!) video containing tips. Another option would be Roth IRAs.

That's all I've got.

Aye.

If you have high-interest debt, pay it off first. This is a low-interest environment. If you are carrying balances on your credit cards, pay them off ASAP and pay in full every month. Brown bag your lunch.

Then, what sean and others have said. If you have a match on a 401K, that's free money. Take as much of it as you can and put it into no-load index funds. If a Roth 401K is an option at your work, take advantage when you are young and your marginal tax rate is lowest. Dollar-cost averaging is your friend. Ditto on 529 accounts for the kids. Start now. If you have loose change left over after these things, then Roth IRA.

Being a quasi- government employee, I'm paying into a state retirement system. The required contribution is 13.2% of gross earnings (6.6% contributed by employee & employer). The employee percentage is deducted pre-tax. Assuming my state retirement system still exists when I retire (shakier than I want to admit given who runs the state right now), should I still consider other sources of retirement income (401k, IRA)? There is a TSA program , but it doesn't have an employer match. I guess what I'm really asking is, should I be thinking about socking away additional resources for retirement, or putting things away for the Poissonnier's education?

I don't know if you have the option for a 401(k) because I recall they are employer sponsored. I could be wrong. That leaves you IRAs. Roth is a popular option but you're limited to $5,500 of contributions a year (this applies to traditional IRAs too but there are still differences). Looks like a primary difference between the two is that an IRA can have tax benefits for that year but you get taxed when you withdraw while a Roth has no tax benefits that year but withdrawal is tax-free (broadly speaking, limitations still apply). You can convert a traditional IRA to a Roth but not the reverse. You do get taxed but you can do it at a time that is advantageous to you. I recall either now or recently there were some tax breaks about that. If you think your tax rate today will be lower than the future, a Roth makes more sense. If you think your tax rate in the future will be lower, then a traditional makes more sense.

Note, I am not a fiduciary and only play one on the internet. If it were me, I think I would opt for a Roth IRA and a 529. How much goes into either is up to you. I think I would bias it to the IRA.

There's a lot of really helpful thought in that answer. I can understand why biasing toward the IRA makes sense. Unless I move into an administrative position my earnings are going to max out at a level where some financial aid is still pretty likely, which perhaps lowers the pressure to put more into a 529 to offset the hit from our expected contribution at a higher income level.

As a government employee, I view my pension (and corresponding university pension, since I am a former member of the liberal elite) as a highly stable baseline of retirement income, similar to Social Security (which I also will have). So my allocations to other investments should be read in light of that low-risk baseline. I'm pretty much 100 percent in stocks via index funds, using the pensions and social security as my asset type diversification in my portfolio (I own several different kinds of index funds).

Your mileage may vary on the risks associated with government pensions. For example, last year I extracted all of my money from the Illinois university retirement system and put it into an IRA, because I was worried about bankruptcy in that state.

I have a 401k (no match) and my wife and I both have Roth IRAs, in addition to my traditional IRA. I expect that our retirement income will not dip all that much from our current income, so the Roth makes more sense than a traditional. Plus, you don't have to draw on it at all if you don't want to in retirement (and thus can use it in estate planning). I will probably look to roll over chunks of that traditional IRA once the Girl is done with college and off the dole.

We invested heavily in 529s for the kids. Both went/are going to Fancy Pants schools, and our income is too high for Pell Grants. 529s are the best vehicle for someone like us to minimize the product of portfolio management headaches, fiscal discipline and tax exposure in planning for college. Whatever you do, try to avoid putting any money in UGMA/UTMA accounts for the kiddies. That is a recipe for minimizing financial aid. Just keep those assets in your own name until they are college seniors, then gift them startup funds if that's what you want to accomplish.

more on 529s vs UGMA/UTMA for saving for college.

You can't go wrong with 529s when there is any doubt. In MO, we even got a state tax break

The 529 contributions are deductible in Wisconsin as well. I have money taken out once a month for each kid automatically, which makes it easier to get it in there.

I think even the earnings were state tax deductible on withdrawal, too

From my reading of this article it seems like you can recharacterize from a Roth to a traditional only for a limited time after recharacterizing the traditional to a Roth. And, the always correct Wikipedia lists an advantage of traditional IRAs as recharacterization to a Roth. But I could be wrong!

Yea, I think you are right. Recharacterization is basically an "undo" of a conversion from traditional to Roth. Thanks for clarifying.

Through a Roth recharacterization, you either change a contribution from a Roth IRA to another type of IRA or nullify a previous Roth conversion. It's as if the contribution or conversion never occurred in the Roth IRA.

Vanguard reports a recharacterization on Form 1099-R as a distribution from the Roth IRA and on Form 5498 as a contribution to the non-Roth IRA. In Box 7 of Form 1099-R, you'll see an "R" for a contribution or conversion made for 2015 and recharacterized in 2016 or an "N" for a contribution or conversion made for 2016 and recharacterized in 2016. Contributions and conversions for 2015 that are recharacterized in 2016 will be reported on 2016 tax forms, which will be distributed in 2017.

You can still recharacterize contributions or conversions for a tax year on or before your federal tax return filing deadline for that tax year, including extensions, even if you already filed your tax return. However, you may need to file an amended return for the tax year in which the original contribution or conversion was made.

Towards my original question though, any thoughts/tips on using professionals?

There may be some value in seeing a financial planner once, to get some general analysis and advice. But brokerage fees and management fees from actively managing your portfolio? Not so much.

The best advice you can probably get: (1) start investing as early as you can, even if small. (2) dollar-cost average. Don't get caught up in short-term market fluctuations unless you like to entertain yourself that way. (3) focus on no-load index funds. (4) don't frick with your investment strategy. More people lose more money by buying and selling too frequently than they do by letting investments ride.

Here's some sage advice from Time's Money Magazine:

Shop locally. As long as you have at least $250,000 to invest—a typical minimum—see what a local financial planner charges. That face-to-face help may be less or no more than what you’d pay for a fund investment advice program. By the end of 2015, Vanguard’s Personal Advisor Services, which costs 0.3% plus costs of underlying investments, should be widely available.

Pay for advice once. If all you need is guidance at the starting gate, you can hire an adviser by the hour instead of spending 1% to 2% a year. You might pay $800 to $1,500 for a one-time plan.

But the scale there should tell you a bit about when it might be worth having such an advisor. IMO.

Agreed. Financial advice early on is good; financial advice later on is a necessity

We absolutely have a financial advisor, and have for over fifteen years now, although we use them more actively the past few years. Of course I'm 10 years or so from thinking of retirement. You don't necessarily need one early on, but keep socking that retirement/college money so that when time comes to start thinking retirement your financial advisor will have something to work with.

If you can find a good financial advisor (when the time comes), definitely do it. It can make a big difference when it comes to when to draw SS or from your IRA/401(k), etc., as well as balancing your investments for the long haul.

I have used a professional for the last seven or eight years (we set up a retirement account for her and rolled over my 401k from my old employer in the beginning, we've added on some other accounts since then: rainy day fund, potential college fund, etc). We've been happy with it, in that our guy (don't know cost, I'm afraid) has kept an eye on things so that our actual interaction with it can be relatively minimal (twice yearly appointments and reading the balance sheets when they come to us). We're good with basic finances, but actual capital 'I' investing is something that neither of us want to put in the time to being good at.

B: Jack Bogle might have some useful things to say about basic investing.

Yes you should use a professional financial planner. Do your parents? Siblings? In-laws? Ask who they use. That's a place to start. Do some research on fees and ask them questions. Find one you feel comfortable with, and hopefully through recommendations, feel like you can trust.

NOTES MY WIFE TOOK (yes ... this is how she actually takes notes. In this regard, I'm proud that she puts me to shame).

Personal Finance Philosophy – 5 things

- Earn a decent living

- This equates to the ability to cover your mortgage, car and vacations

- Once you reach that tipping point, making more money will not make you happier

- Making less money will make you less happy

- Spend Less than You Make

- Take Money you don’t spend , save and invest à make your $ work for you

- Avoid being ‘Financially Fragile’ (i.e. not having enough liquid savings to cover large unplanned expenses)

- Max out your 401K (match)

- Save more when you can (e.g. years with larger bonuses)

- Protect financial Work (or was it worth)

- Life Insurance (not when single, but when married and/or with kids)

- Disability Insurance (especially when single and/or when sole earner)

- Basic Estate Plan (again, critical with kids. . . should cost $1000 or less) – includes:

- Will

- Healthcare Proxy

- Durable Power of Attorney

- Healthcare Directive

- Give Back

- Volunteer, Donations etc.

Investments

- Control what you can control

- Investment Expense (i.e. “Fees)

- Index Funds and/or ETFS

- Amount of Risk you’re taking

- Reduce your risk over time. . . . . especially close to the life event (e.g. retirement/collected)

- If you invest in “Target Date” funds (e.g. Lifepath Funds) invest all or none – don’t go halfsies

- Investment Expense (i.e. “Fees)

Term vs. Permanent (aka Cash Value) Life Insurance

- Start with “Term” Life Insurance

- Covers your bases until you accrue enough in retirement accounts to cover your bases

- Or Covers your family until they are independent

- Max out the Group Term Benefit (e.g. Target allows you to add up to 6X salary, do that – it’s cheap)

- Look at Life Insurance Worksheet online to determine “How Much)

- Permanent

- Use when your need for Life Insurance won’t end (e.g. when you have a disabled/dependent child)

- Jean is not a fan of Permanent Life Insurance as an investment vehicle

- Exception = Immediate Annuity – e.g. to manage income during retirement

Savings for College

- Retirement should come first

- 529s generally better than Roth IRAs (for this purpose)

- 529s can save more $

- Roth IRA – can choose to use for college OR retirement

- Both grow tax free

- Research 529s à find the best one

- Savingsforcollege.com - - ranks 529 plans

- In general better to ‘Divide and Conquer’ your savings

- You are more likely to meet your goals if you have different savings buckets for different goals

More on Retirement Savings - Steps

- Emergency fund – always have a minimum of $2000 liquid

- Save 3X monthly expenses for Dual Income

- Save 6X monthly expenses for Single Income

- Max out your 401K first – at the “Match”

- Pay down debt that has an interest rate higher than your savings returns

- Invest everything else in the future

- Max out total 401K to Yearly Limit (in 2015 = $18K)

- And/Or invest in Roth

- Automate everything you can (savings, investments, debt payments)

- Guidelines for how much you should have saved (per “Fidelity)

- Age 35 = 1X current salary

- Age 45 = 3X

- Age 55 = 5X

- Age 65 = 8X

- Other:

- Longevity rates are going up

- Plan on Living to 95

- Plan on needing 85% of Pre-Retirement Income

- Longevity rates are going up

Pros and Cons of EDCP (Executive Deferred Compensation Plan)

- More than $18K allowed and not eligible for IRA

- Longevity rates are going up

Financial Planning – When and How Often?

- 1X year – basic financial physical

- What you earn, vs. Own. Vs. Owe – review that these are all moving in the right direction

- Progress on Retirement Goals (calculate)

- 3X year – check credit report

- Look for Identity Theft and take action ASAP

- Annualcreditreport.com

- Read/review your statements

- Know your credit score (but don’t need to check as often) 720 = Good; 760+ = Great

- Look for Identity Theft and take action ASAP

Saving for College – Should Kids take the Loans or Parents

- Have the kids borrow some of the money (if you haven’t saved enough already and/or financial aid doesn’t cover)

- Have them borrow no more in total than what they expect to make in their first year

- Borrow w/ Federal Loans when possible

- You can help repay their loans.

Aging Parents

- Unlike Kids/College, - ‘We’ help b/c there is no other choice (e.g. ‘Financial Aid’)

- Important to understand their ‘need’

- Open and Honest Communication

- Have a Social Security Strategy

- Delay tapping into Social Security as long as Possible

- Grows @ 8% from age 62 to 70

- This is a point where it makes sense to pay for advice

- Review: maximizemysocialsecurity.com

- There are social security estimators available; seek them out

- Delay tapping into Social Security as long as Possible

Risk Adverse? Where else to save

- Credit Unions à interest bearing accounts

- Government Bonds

- Note: Regular savings accounts equate to losing money after inflation/taxes, etc.

Using 401K or Personal Investments for Debt Reduction

- BAD – have to pay $ back within 60 days if leave company (whether by choice or not) – otherwise pay tax penalty

- Better to ‘pull back’ on regular contributions and pay back debt that way

What to do if I’m a Named Guardian

- Understand financial responsibility; Do the Parents have life Insurance?

Kids, Finances and Allowance – when to start, how to structure and how much?

- Start at age 5

- $1 (week)

- Add $1 every year

- Think of things you want them to start buying themselves

- Help them with “Give, Save, Spend” parameters

- Always save 10% - get them in this habit early

Buying and Selling Stock – when?

- The advisor doesn’t manage $ this way - -- - she invests in diversified funds

- Other investors sell when stock price drops 10-15%

- Exception is when price is affected by an exaggerated news story

- And/or the Entire Market drops

- Other investors sell when stock price drops 10-15%

When do you go to a Financial Advisor?

- When do you go to a Financial Advisor?

- When your financial life gets more complicated

- Kids, homes, raises/promotions,

- When your financial life gets more complicated